Chipotle’s Business Model and Performance

Chipotle Mexican Grill is a popular fast-casual restaurant chain that has become a household name for its fresh, customizable, and flavorful menu. The company’s success can be attributed to its unique business model and strong brand identity. This section will delve into the intricacies of Chipotle’s business model, its recent financial performance, and a comparative analysis with its competitors in the fast-casual restaurant industry.

Chipotle’s Business Model, Chipotle stock

Chipotle’s business model is centered around a focus on fresh, high-quality ingredients, customizable menu options, and a commitment to sustainability. The company’s core strengths include:

- Fresh, High-Quality Ingredients: Chipotle uses fresh, whole ingredients, avoiding artificial flavors, preservatives, and genetically modified organisms (GMOs). This focus on quality has resonated with health-conscious consumers and helped build a strong brand reputation.

- Customizable Menu: Chipotle’s menu is simple yet versatile, allowing customers to personalize their orders by choosing their preferred ingredients and toppings. This customization empowers customers and fosters a sense of control over their meal, contributing to customer satisfaction.

- Strong Brand Identity: Chipotle has cultivated a strong brand identity based on its commitment to fresh, sustainable, and ethical practices. The company’s focus on transparency and ingredient sourcing has resonated with consumers who value these principles.

- Efficient Operations: Chipotle’s streamlined operations, including its assembly-line style service and limited menu, allow for quick and efficient service. This efficiency helps to minimize wait times and maximize throughput, leading to higher customer satisfaction and increased profitability.

However, Chipotle’s business model also has some weaknesses:

- Higher Prices: Compared to other fast-casual restaurants, Chipotle’s prices are generally higher, which can be a deterrent for price-sensitive customers.

- Labor Costs: Chipotle’s emphasis on fresh ingredients and customizable orders requires a higher level of labor input, which can contribute to higher labor costs.

- Food Safety Concerns: Chipotle has faced several food safety challenges in the past, including outbreaks of E. coli and norovirus. These incidents have tarnished the company’s reputation and led to decreased customer confidence.

Chipotle’s Financial Performance

Chipotle’s financial performance has been impressive in recent years, with consistent revenue growth and increasing profitability. However, the company’s performance has been impacted by factors such as the COVID-19 pandemic and food safety concerns.

Revenue Growth

Chipotle’s revenue has grown steadily over the past few years, driven by new restaurant openings, increased customer traffic, and higher average check sizes. In 2022, the company’s revenue reached $8.5 billion, representing a significant increase from $6.9 billion in 2021. This growth is a testament to Chipotle’s strong brand appeal and its ability to adapt to changing consumer preferences.

Profitability

Chipotle’s profitability has also been on an upward trend, with the company’s net income increasing significantly in recent years. In 2022, Chipotle’s net income reached $1.4 billion, a substantial improvement from $1.1 billion in 2021. This increase in profitability is attributed to factors such as higher revenue, improved operational efficiency, and a focus on cost management.

Debt Levels

Chipotle’s debt levels have remained relatively low in recent years. The company has a strong balance sheet and has consistently maintained a healthy debt-to-equity ratio. This low debt level provides Chipotle with financial flexibility and allows it to invest in growth initiatives.

Chipotle’s Performance Compared to Competitors

Chipotle faces competition from a wide range of players in the fast-casual restaurant industry, including other burrito chains, sandwich shops, and salad bars. Some of Chipotle’s key competitors include:

- Qdoba Mexican Eats: Qdoba is a similar concept to Chipotle, offering customizable burritos, bowls, and salads. The company has a strong presence in the United States and is known for its value-oriented pricing.

- Moe’s Southwest Grill: Moe’s is another popular fast-casual chain that specializes in Southwestern-inspired food. The company offers a variety of customizable options, including burritos, quesadillas, and tacos.

Here is a table comparing key performance indicators for Chipotle and its competitors:

| Metric | Chipotle | Qdoba | Moe’s |

|---|---|---|---|

| Revenue (2022) | $8.5 billion | $1.1 billion | $0.7 billion |

| Net Income (2022) | $1.4 billion | $0.1 billion | $0.05 billion |

| Same-Store Sales Growth (2022) | 10.1% | 7.2% | 4.5% |

| Debt-to-Equity Ratio (2022) | 0.2 | 0.4 | 0.6 |

As the table shows, Chipotle outperforms its competitors in terms of revenue, net income, and same-store sales growth. The company also has a lower debt-to-equity ratio, indicating a stronger financial position.

Industry Trends and Growth Opportunities

The fast-casual restaurant industry is a dynamic and competitive sector, constantly evolving to meet the changing preferences of consumers. This section explores the key trends shaping the industry and identifies potential growth opportunities for Chipotle.

Consumer Preferences and Technological Advancements

Consumers are increasingly seeking fresh, high-quality food prepared with real ingredients. This trend has driven the growth of fast-casual restaurants, which offer a more upscale dining experience than traditional fast food chains. In addition, consumers are increasingly using technology to order and pay for food, and they are looking for restaurants that offer convenient ordering options, such as online ordering and mobile apps.

Growth Opportunities for Chipotle

Chipotle has a strong foundation for growth, given its focus on fresh ingredients, customization options, and a commitment to sustainability. Here are some potential growth opportunities for the company:

- Expanding into new markets: Chipotle has a significant presence in the United States, but there is room for expansion into new domestic markets and international markets. The company could consider expanding into areas where there is a strong demand for fast-casual dining and where its brand resonates with consumers.

- Developing innovative menu items: Chipotle can continue to innovate its menu by offering new and exciting dishes that appeal to a wide range of consumers. This could include expanding its vegetarian and vegan offerings, as well as incorporating new flavors and ingredients.

- Leveraging technology: Chipotle can leverage technology to improve its operations and enhance the customer experience. This could include investing in mobile ordering and delivery services, as well as using data analytics to better understand customer preferences and optimize its menu and marketing strategies.

Impact of Rising Food Costs and Labor Shortages

The fast-casual restaurant industry is facing a number of challenges, including rising food costs and labor shortages. These challenges are putting pressure on restaurants to increase prices and find ways to reduce costs. Chipotle has been impacted by these challenges, but the company has taken steps to mitigate their impact, such as raising prices, investing in automation, and offering competitive wages and benefits to attract and retain employees.

Fast-Casual Restaurant Industry Landscape

The fast-casual restaurant industry is highly competitive, with a number of major players vying for market share. Here is a visual representation of the industry landscape:

[Visual representation of the fast-casual restaurant industry landscape, including major players and their market share]

This representation shows the relative size of the major players in the fast-casual restaurant industry, including Chipotle. It highlights the competitive nature of the industry and the need for restaurants to differentiate themselves in order to succeed.

Chipotle’s Stock Valuation and Investment Potential: Chipotle Stock

Chipotle Mexican Grill (CMG) has consistently delivered strong financial performance, driven by its commitment to fresh ingredients, high-quality food, and a loyal customer base. Understanding the company’s current valuation and future growth prospects is crucial for investors seeking to capitalize on its potential.

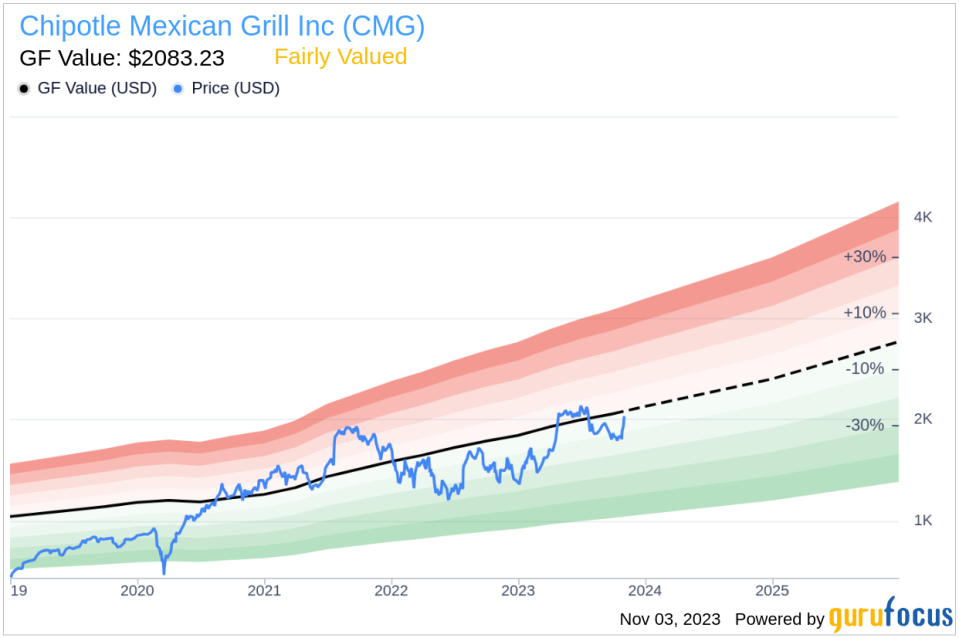

Current Stock Valuation

Chipotle’s stock valuation is assessed using various metrics, including price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio. The P/E ratio measures the price of a stock relative to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. The P/S ratio compares the company’s market capitalization to its revenue, reflecting its revenue generation potential.

As of November 14, 2023, Chipotle’s P/E ratio was approximately 45.96, while its P/S ratio was around 3.55. These ratios are considered relatively high compared to the broader restaurant industry, reflecting investor confidence in the company’s future growth prospects.

Factors Influencing Chipotle’s Stock Price

Several factors can influence Chipotle’s stock price in the future, including:

- Earnings Growth: Continued strong earnings growth is a key driver of stock price appreciation. Chipotle has consistently exceeded earnings expectations, indicating robust demand for its offerings and efficient operations.

- Expansion Plans: Chipotle’s aggressive expansion strategy, including opening new restaurants in both existing and new markets, can contribute to revenue growth and stock price appreciation.

- Market Sentiment: Overall market sentiment and investor confidence in the restaurant sector can significantly impact Chipotle’s stock price. Positive sentiment and strong investor confidence can lead to higher valuations, while negative sentiment can result in price declines.

- Competition: Increased competition from other fast-casual and quick-service restaurants could impact Chipotle’s market share and profitability, potentially affecting its stock price.

- Inflation and Economic Conditions: Rising inflation and economic uncertainty can impact consumer spending and demand for restaurant dining, potentially affecting Chipotle’s sales and stock price.

Comparison with Other Restaurant Companies

When comparing Chipotle’s valuation to other restaurant companies, it’s essential to consider factors like size, growth prospects, and profitability. Some notable competitors include McDonald’s (MCD), Starbucks (SBUX), and Yum! Brands (YUM).

Chipotle’s valuation is generally higher than these companies, reflecting its premium pricing strategy, focus on fresh ingredients, and strong brand loyalty. However, it’s important to consider the relative growth potential and risk profiles of each company when making investment decisions.

Potential Investment Scenarios

The following table Artikels different potential scenarios for Chipotle’s stock price, considering various factors that could influence its future performance:

| Scenario | Stock Price Target | Rationale |

|---|---|---|

| Base Case: Continued Strong Growth | $2,000 – $2,200 | Chipotle maintains its current growth trajectory, expanding its restaurant footprint and increasing same-store sales. Earnings continue to exceed expectations, driven by strong demand and operational efficiency. |

| Bullish Case: Accelerated Growth | $2,500 – $3,000 | Chipotle surpasses its growth targets, fueled by new product launches, expanded digital ordering capabilities, and successful international expansion. The company’s brand continues to resonate with consumers, leading to increased market share and profitability. |

| Bearish Case: Slower Growth | $1,500 – $1,800 | Chipotle faces challenges in maintaining its growth momentum, due to increased competition, rising labor costs, or economic headwinds. The company’s expansion plans are slowed, and earnings growth is more modest than anticipated. |

Chipotle stock, known for its volatility, can be a risky yet potentially rewarding investment. The company’s focus on fresh ingredients and sustainable practices aligns with the values of institutions like Miami University , a renowned institution known for its commitment to environmental stewardship and ethical business practices.

Investors looking to align their portfolios with such values may find Chipotle stock an intriguing option.

Chipotle stock, traded under the ticker symbol CMG, has seen a surge in recent years, driven by the company’s focus on fresh ingredients and its commitment to sustainability. For a deeper dive into the factors contributing to Chipotle’s growth, you can explore the analysis of cmg stock.

This exploration reveals how Chipotle’s dedication to its core values has translated into positive financial performance and a strong brand image, making it a compelling investment opportunity for many.